[ad_1]

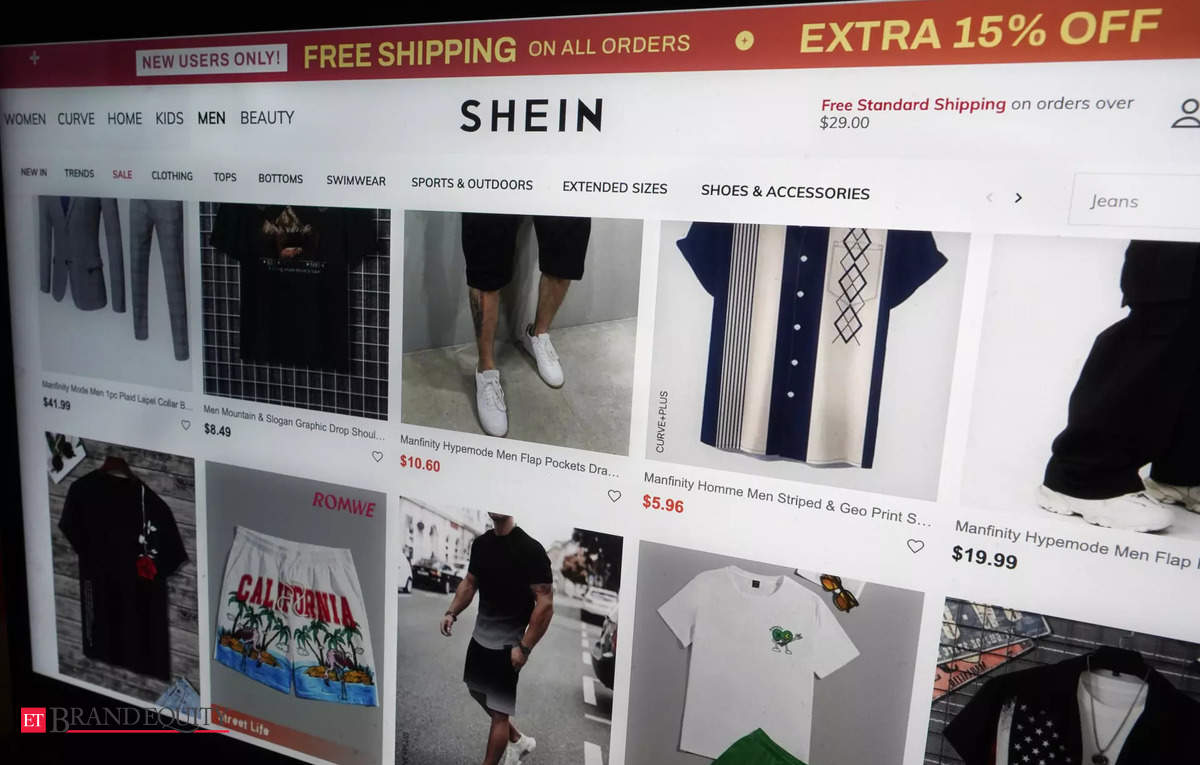

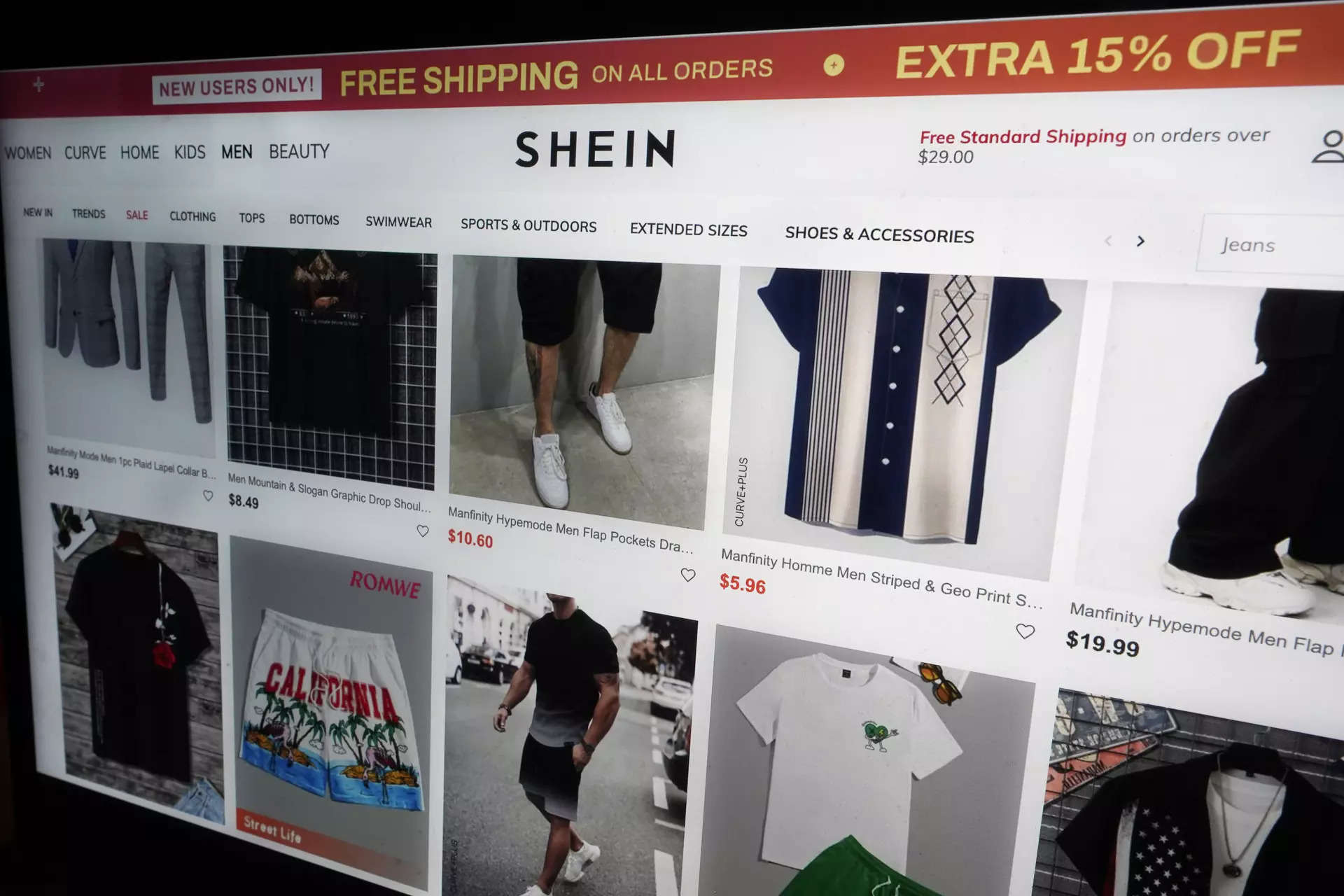

Fashion company Shein is seeking Beijing’s nod to go public in the U.S., two sources with knowledge of the matter said, a decision which could delay its float plans and comes despite efforts to distance itself from China.

The Singapore-based company, valued at $66 billion in a May fundraising according to one of the sources, filed with the Chinese regulator in November to comply with new listing rules for local firms, two sources with knowledge of the matter said.

Shein’s listing plans are likely not only to face tougher-than-expected scrutiny from U.S. regulators in an election year in the U.S., the sources said, but will also have to go through a lengthy approval process with numerous Chinese regulators.

Shein, which sells cheap fashion in over 150 countries, confidentially filed to go public in the United States in November and could launch its new share sale in 2024, in what is likely to be one of the most valuable China-founded companies to list in New York, Reuters has reported citing sources.

Shein also filed with the China Securities Regulatory Commission (CSRC) for the U.S. float, making it subject to Beijing’s new listing rules for Chinese firms going public offshore, said the sources.

The sources declined to be identified as they were not authorised to speak to media.

Shein did not reply to a request for comment on Friday, and neither did the CSRC.

The filing with the CSRC puts into question Shein’s efforts over the years to distance itself from China and position itself as a global company, which included moving its headquarters to Singapore from Nanjing, capital of China’s eastern Jiangsu province, in late 2021.

Reuters reported in early 2022 that Shein’s founder and CEO Chris Xu had also become a permanent resident of Singapore.

Chinese listing rules that came into effect in March last year stipulate that local firms wanting to list in offshore markets will need to make a filing with the CSRC and receive clearance from domestic regulators before proceeding.

Before the new rules were framed, Didi Global ran afoul of Chinese authorities by pushing ahead with its $4.4 billion U.S. IPO in 2021 while a review of its data practices was being conducted.

The ride-hailing firm later delisted from the New York stock exchange and was fined $1.2 billion over data-security breaches.

Under the CSRC rules, a host of authorities such as the National Development and Reform Commission, which supervises foreign holdings in local firms, the cybersecurity regulator and others may get involved in approving offshore IPO applications.

That is likely to lead to more uncertainty as some agencies have different priorities such as national security or data protection, bankers have said.

According to the new rules, if an applicant has 50% or more of its operating revenue, profit, total assets or net assets generated in mainland China and meanwhile the main parts of its business activities are conducted in the country or senior managers in charge of its business operation and management are mostly Chinese citizens or domiciled on the mainland, it would be recognized as a Chinese company and subject to the new rules.

The rules also say that the determination of whether it is an offshore listing by a Chinese company should be made on “a substance over form” basis, which lawyers and bankers said gives CSRC discretion.

Shein, which employs more than 11,000 people, according to its website, produces clothing in China to sell online in the United States, Europe and Asia excluding China.

It does not own or operate any manufacturing facilities and instead works with around 5,400 third-party contract manufacturers, mainly in China. It ships the majority of its products directly from China to shoppers by air in individually addressed packages.

As Shein’s operation and business largely rely on a supply chain and manufacturers in China, the CSRC would expect it to be subject to its new rules, one of the sources said.

[ad_2]

Source link