[ad_1]

India’s mobile broadband (MBB) user base grew at a modest 7.2% in the last one year to 839 million though the pace of additions accelerated from August fuelled by greater adoption of Reliance Jio’s affordable internet-enabled 4G phone.

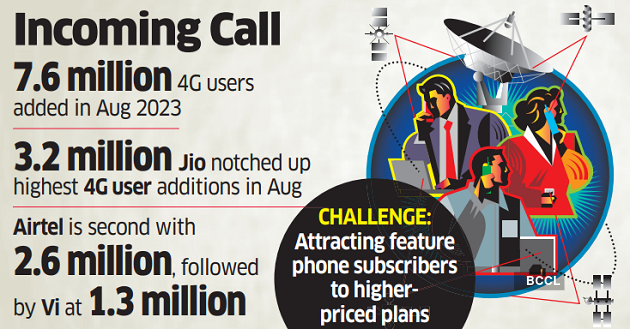

The scenario underlines the challenges for telcos to entice featurephone users to upgrade to pricier plans that offer higher margins. Industry executives and analysts are, however, optimistic that the growth in 4G subscriptions will continue during the festive season and the rest of the financial year thanks to stable tariffs and fall in 4G handset prices.

India’s non-MBB or ‘2G’ user base shrunk around 16% in the 12 months through August to 309 million, showed telco subscriber data issued by the Telecom Regulatory Authority of India (Trai).

“That India’s mobile broadband user base (primarily 4G) rose modestly during August 2022-23 suggests telcos continued to face challenges in pushing feature phone users to go 4G…. but the sharp growth in MBB user additions from August 2023 onwards suggests strong adoption of the Jio Bharat device,” Nitin Soni, senior director (corporates), at Fitch Ratings, told ET.

The executives and analysts said 4G user additions will be driven by conversions from 2G amid a 12% decline in 4G smartphone prices in recent months.

With headline tariffs unlikely to rise anytime soon, the upgrades are key to telcos’ push to boost average revenue per user (ARPU). But given the slow pace of upgradation, Jio’s push to upgrade all 2G users to 4G may still be some time away, say experts.

According to Trai, the sector added a record 7.6 million 4G users in August 2023 – well above the average 4.6 million monthly 4G user additions in the last one year. On the heels of the launch of the Jio Bharat device in July, Jio notched up the highest 4G user additions (3.2 million) in August, followed by Airtel (2.6 million) and Vodafone Idea (1.3 million).

Going forward, Soni expects the recent spurt in 4G user adds to sustain. He explained that the likelihood of headline tariff hikes being unlikely in the near term will encourage both Bharti Airtel and Reliance Jio to prioritise rapid 2G to 4G conversions in both urban and rural markets to stimulate data consumption and boost ARPU.

The recent fall in 4G device prices is also likely to drive faster 2G to 4G conversions, said Soni.

Research firm IDC estimates that the average selling price (ASP) of 4G smartphones fell almost 12% to $109 in the September quarter of CY2023, from $123 in the March quarter.

According to handset market trackers at CMR, 4G feature phone shipments saw a whopping 300% on-year jump in the September quarter. This was led by Jio Bharat-Version 1, Karbonn and Jio Bharat-Version 2, who collectively captured 63% market share. In contrast, 2G feature phone shipments plunged 27% on-year in the same period.

Airtel MD Gopal Vittal recently estimated that in markets like Gujarat, Delhi and Kerala, 2G devices now account for less than 7-8% of total mobile devices on the network, and in Mumbai, it’s even less. Only Uttar Pradesh, Bihar, Odisha and Rajasthan still have a reasonable chunk of 2G devices on mobile networks, he had said earlier this month.

Industry executives and analysts, though, said quality revenue-generating customer wins in high volumes won’t come easy since the top three telcos reported sluggish sequential ARPU rises in the September quarter despite posting decent 4G user additions.

Jio, Airtel and Vi reported 0.66%, 1.5% and 2.1% sequential ARPU growth in the quarter despite adding 11.2 million, 7.7 million and 1.8 million 4G users respectively in the fiscal third quarter.

During Airtel’s Q2 earnings call, Airtel’s Vittal had attributed the phenomenon to a narrowed price gap between entry-level mobile plans and starter-smartphone plans. “The gap between the entry-level plans and (base) smartphone plans has started compressing, and is now only Rs 60…so to that extent, every feature phone to smartphone upgrade gives you a slightly lower upside compared to what it was in prior quarters (when the gap was around Rs 140).

[ad_2]

Source link