[ad_1]

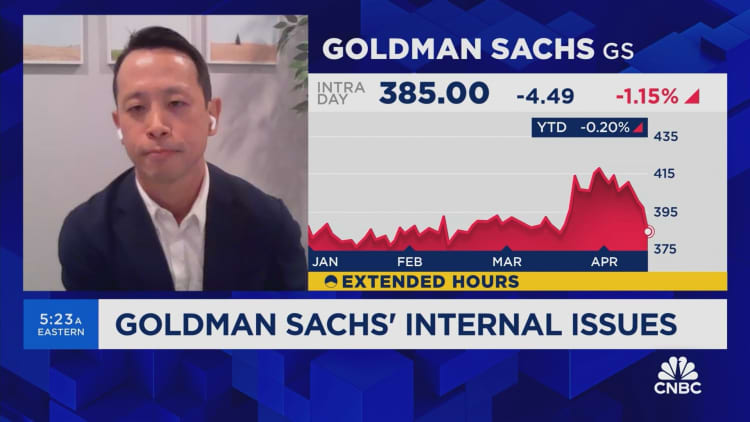

Goldman Sachs on Monday posted first-quarter profit and revenue that topped analysts’ expectations, fueled by a surge in trading and investment banking revenue.

Here’s what the company reported:

- Earnings: $11.58 per share, vs. $8.56 expected, according to LSEG

- Revenue: $14.21 billion, vs. $12.92 billion expected

The bank said profit jumped 28% to $4.13 billion, or $11.58 per share, from the year earlier period, thanks to a rebound in capital markets activities. Revenue rose 16% to $14.21 billion, topping analysts’ estimates by more than $1 billion.

Goldman shares climbed about 3% Monday.

Fixed income trading revenue rose 10% to $4.32 billion, topping the StreetAccount estimate by $680 million, thanks to a jump in mortgage, foreign exchange, and credit trading and financing. Equities trading climbed 10% to $3.31 billion, about $300 million more than expected, on derivatives activity.

Investment banking fees surged 32% to $2.08 billion, topping the estimate by roughly $300 million, driven by higher debt and equity underwriting.

Goldman’s results are likely the best of its big bank peers this quarter, Wells Fargo banking analyst Mike Mayo said Monday in a research note.

Goldman CEO David Solomon has taken his lumps in the past year, but a turnaround appears to be underway as memories of the moribund capital markets and missteps tied to Solomon’s ill-fated push into retail banking begin to fade.

Like rivals JPMorgan Chase and Citigroup, which each posted better-than-expected trading and investment banking results for the first quarter, Goldman took advantage of improving conditions since the start of the year.

“I’ve said before that the historically depressed levels of activity wouldn’t last forever,” Solomon told analysts Monday in a conference call. “CEOs need to make strategic decisions for their firms, companies of all sizes need to raise capital, and financial sponsors need to transact to generate returns for their investors… It’s clear that we’re in the early stages of a reopening of the capital markets.”

Unlike more diversified rivals, Goldman gets most of its revenue from Wall Street activities. That can lead to outsized returns during boom times and underperformance when markets don’t cooperate.

After pivoting away from retail banking, Goldman’s new emphasis for growth has centered on its asset and wealth management division.

But that was the only Goldman business that didn’t top expectations for the quarter: Revenue in the business rose 18% to $3.79 billion, essentially matching the StreetAccount estimate, on higher private banking and lending revenue, rising private equity stakes, and climbing management fees.

Revenue in the bank’s smallest division, Platform Solutions, jumped 24% to $698 million, topping estimates by about $120 million, fueled by a rise in credit card and deposit balances.

[ad_2]

Source link